Barriers to entry make small balance commercial loans a new asset class for most investors. The ICA team, with over 100 years of combined experience, provides economic access to this market.

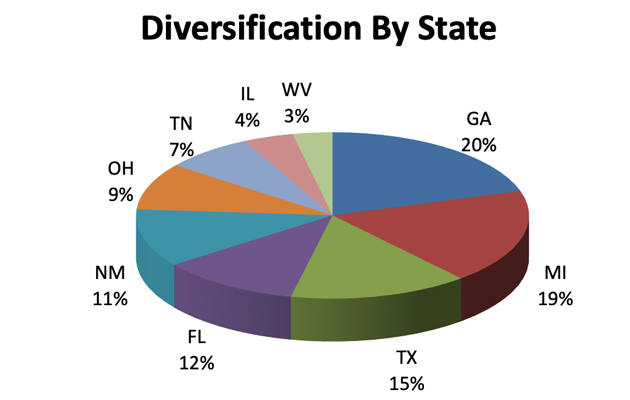

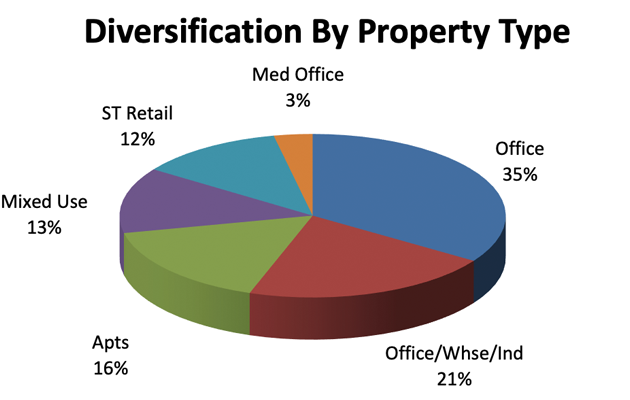

Through conservative underwriting and broad diversification, ICA Lending delivers secure, low risk exposure to the small balance commercial mortgage market.

ICA Loans produce 50-200 basis points of incremental yield, net of fees, versus readily available public market alternatives

Each individual loan has 100% yield maintenance provisions to ensure superior convexity through locked in cash flows

- ICA’s Loans have a 6-7.5 year duration.

- ICA has developed a 3-5 year duration product which is available for investors.

- ICA provides monthly and annual reports to its clients which are available online through its web site. These include bank statements, Individual Schedule B Reports, RBC, and AM Best reports.

Information regarding ICA’s most recent loans are provided in the table below:

| 2020-02 | |

| Loans Originated | $25,345,000 |

| Date Originated | 7/2020 |

| Number of Loans | 15 |

| Number of States | 9 |

| Net Spread to 10-year Treasury | 300 |

| Net Yield: Bond Equiv. | 3.93% |

| Average Loan to Value | 66% |

| % Yield Maintenance | 100% |

| DSC | 1.85 |

| RBC Rating | 100% CM1 |